IRS 9297 2009-2025 free printable template

Show details

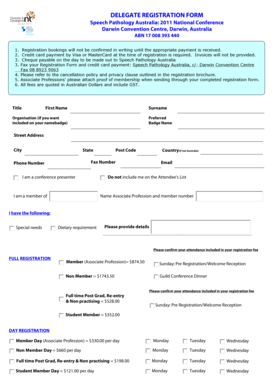

Revenue Officer name Date Telephone number Office address Form 9297 Rev. 05-2009 Catalog No. 12826E www.irs.gov Department of the Treasury Internal Revenue Service. Summary of Taxpayer Contact Taxpayer s name Taxpayer s ID Information/Documents required Date required Notification of consequences of failure to meet the above deadlines Failure to meet the above deadlines by the specified date s may require the IRS to take certain actions such as issuing a summons issuing a Notice of Levy or...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign form 9297 download

Edit your taxpayer tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your taxpayer number form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing number tax online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit claiming tax form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 9297 pdf

How to fill out IRS 9297

01

Obtain IRS Form 9297 from the IRS website or your tax professional.

02

Fill in your personal information, including your name, address, and taxpayer identification number.

03

Indicate the tax period for which you are submitting the form.

04

Describe the information you are providing and the reason for submitting the form.

05

Double-check all entries for accuracy and completeness.

06

Sign and date the form.

07

Submit the form by mailing it to the appropriate IRS address or by following any electronic submission guidelines.

Who needs IRS 9297?

01

Individuals who are responding to an IRS notice regarding a tax return issue.

02

Taxpayers who need to clarify discrepancies with their tax return or provide additional information.

Fill

irs office

: Try Risk Free

People Also Ask about form 9297

Where can I go to get IRS forms?

Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676). Hours of operation are 7 a.m. to 10 p.m., Monday-Friday, your local time — except Alaska and Hawaii which are Pacific time.

Are IRS forms available online?

Free File Fillable Forms are electronic federal tax forms you can fill out and file online for free, enabling you to: Choose the income tax form you need. Enter your tax information online. Electronically sign and file your return.

How do I talk to customer service for IRS?

Contact an IRS customer service representative to correct any agency errors by calling 800-829-1040 (see telephone assistance for hours of operation).

What is IRS online services?

E-Services is a suite of web-based tools that allow tax professionals, reporting agents, mortgage industry, payers and others to complete transactions online with the IRS. All e-Services users must accept the User Agreement in order to access accounts.

Is it worth having an IRS online account?

Tax experts advise creating an IRS online account just in case you run into a tax issue or problem in the future. It's better to have an account already created than be forced to register online during the stress of a tax difficulty already in progress.

What number is 800 829 8374?

Tax practitioners with account or tax law questions may call 800-829-8374.

How do I fill out a tax form online?

0:19 1:50 How to Fill Out Tax Forms Online (Step-by-Step Guide) - YouTube YouTube Start of suggested clip End of suggested clip Use the online editor to complete the required. Fields. If your form requires signingMoreUse the online editor to complete the required. Fields. If your form requires signing create your personal electronic signature in a few clicks.

How do I fill out an IRS file for free?

Choose an IRS Free File option, guided tax preparation or Free File Fillable Forms. You will be directed to the IRS partner's website to create a new account or if you are a previous user, log in to an existing account. Prepare and e-file your federal tax return. Receive an email when the IRS has accepted your return.

What are the IRS online services?

E-Services is a suite of web-based tools that allow tax professionals, reporting agents, mortgage industry, payers and others to complete transactions online with the IRS. All e-Services users must accept the User Agreement in order to access accounts.

Can I fill out tax forms electronically?

Yes, you can file an original Form 1040 series tax return electronically using any filing status. Filing your return electronically is faster, safer, and more accurate than mailing your tax return because it's transmitted electronically to the IRS computer systems.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get irs form 9297?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the 9297 download in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I create an electronic signature for the number auto in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your irs 9297 in minutes.

How can I fill out irs office locations on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your irs customer service number. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is IRS 9297?

IRS 9297 is a form used by taxpayers to report information regarding a payment made to a tax professional or a third-party sender for tax services.

Who is required to file IRS 9297?

Taxpayers who have made payments for tax preparation services that exceed a certain threshold are required to file IRS 9297.

How to fill out IRS 9297?

To fill out IRS 9297, taxpayers should provide their personal information, the payment details, and the tax professional's information on the form.

What is the purpose of IRS 9297?

The purpose of IRS 9297 is to ensure transparency regarding payments to tax professionals and to assist the IRS in tracking tax preparation services provided to taxpayers.

What information must be reported on IRS 9297?

The information that must be reported on IRS 9297 includes the taxpayer's name, address, the amount paid, and the name and address of the tax professional or third-party sender.

Fill out your IRS 9297 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs Contact Number is not the form you're looking for?Search for another form here.

Keywords relevant to irs service

Related to taxpayer credit

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.